- Wealth management

- Papers

- Perspectives

Olivier Marciot

Executive Director

Head of Investments Multi Asset Solutions

After a decade of zero interest rate monetary policies that ended in a bloodshed for bond investors in 2022, the investment landscape has finally returned to a more traditional backdrop: higher rates and more attractive fixed income. Goldilocks and TINA (There Is No Alternative) are now gone and investors need to rethink asset allocation accordingly: fixed income, a long-time-no-see asset class is back in fashion and has a lot to offer in the next few years, especially compared to its riskier equity counterparts.

How should investors position portfolios for the months and years to come? What is the best way to take advantage of this window of opportunity? How long will it last? All these questions must be addressed.

Think again

Tree, 2020

The fixed income opportunity - reloaded

With great crises come great opportunities

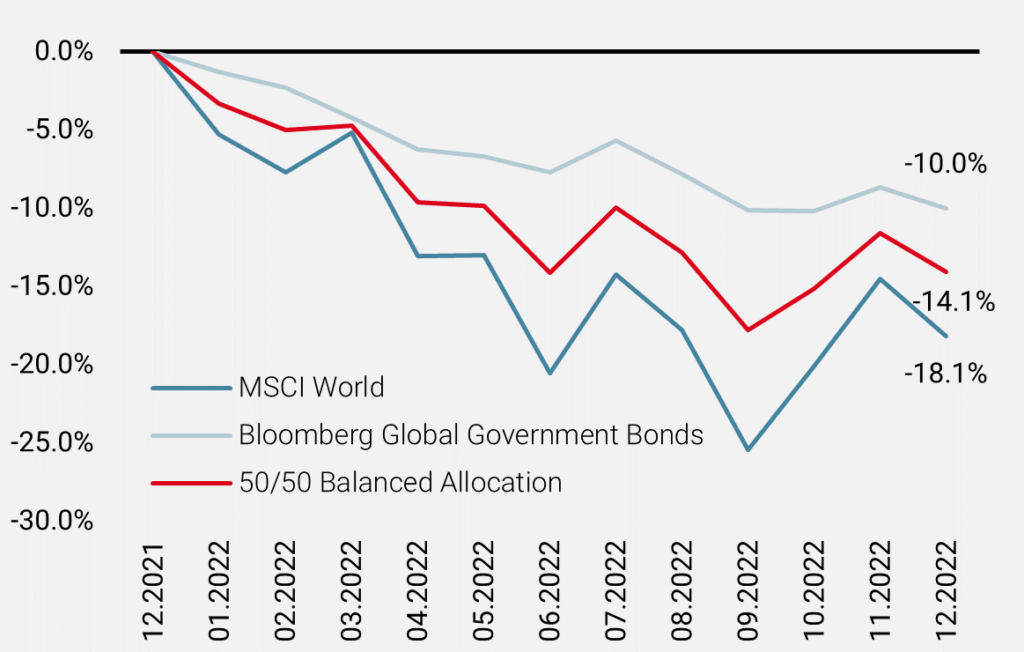

The pain caused for bond investors by the sharpest and swiftest tightening cycle of the past four decades may only be equalled by the opportunity it now presents. For the first time in most money managers’ careers, the “safe” allocation in diversified portfolios detracted – a lot – and at the worst of times given stock indices incurred heavy losses as well. Looking at so-called “balanced” portfolios (holding as much bonds as stocks), the proportion of the current drawdown driven by the fixed income sleeve has for the first time durably exceeded 50%, leaving asset owners and asset managers in shock, with nowhere to hide.

A tale of blood, sweat and tears

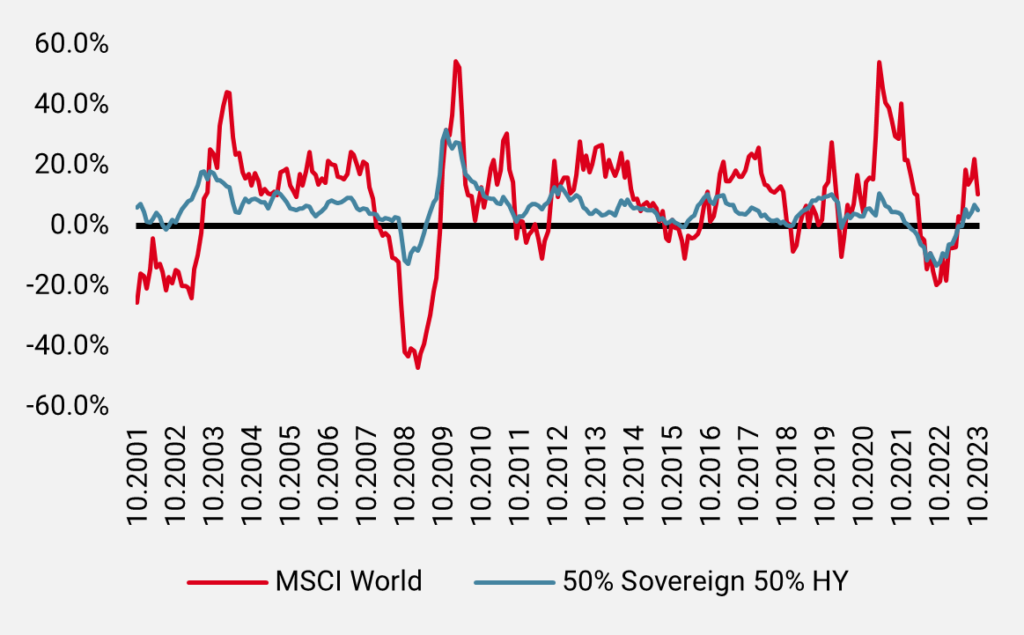

Figure 1: An unprecedented correlation shock

Source: Bloomberg, Unigestion. As of 31.10.2023.

Over the past 20+ years, three distinct phases of equity/bond relationships have been be observed, as shown in Figure 1. Between 2000 and 2010, the correlation between the two asset classes was intuitive (if not normal): sovereign bonds offered positive returns during equity corrections and any pain suffered by bond investors during “bad times” was usually either non-existent (meaning returns remained positive) or low, averaging a proportion of 5%.

During the post-GFC era, between 2010 and 2020, this proportion increased to 10%, with brief peaks observed during 2013’s taper tantrum and 2015-2018’s tightening cycle.

The third and last phase has been the post-Covid era, and the major correlation shock that ensued, with the correlation between bonds and equities converging to 1 and the proportion of bond losses rising to 50% durably in 50/50 balanced allocations.

Figure 2: Contributors to diversified portfolios drawdowns

Source: Bloomberg, Unigestion. As of 31.10.2023.

The pain was real, but what does it mean for the future?

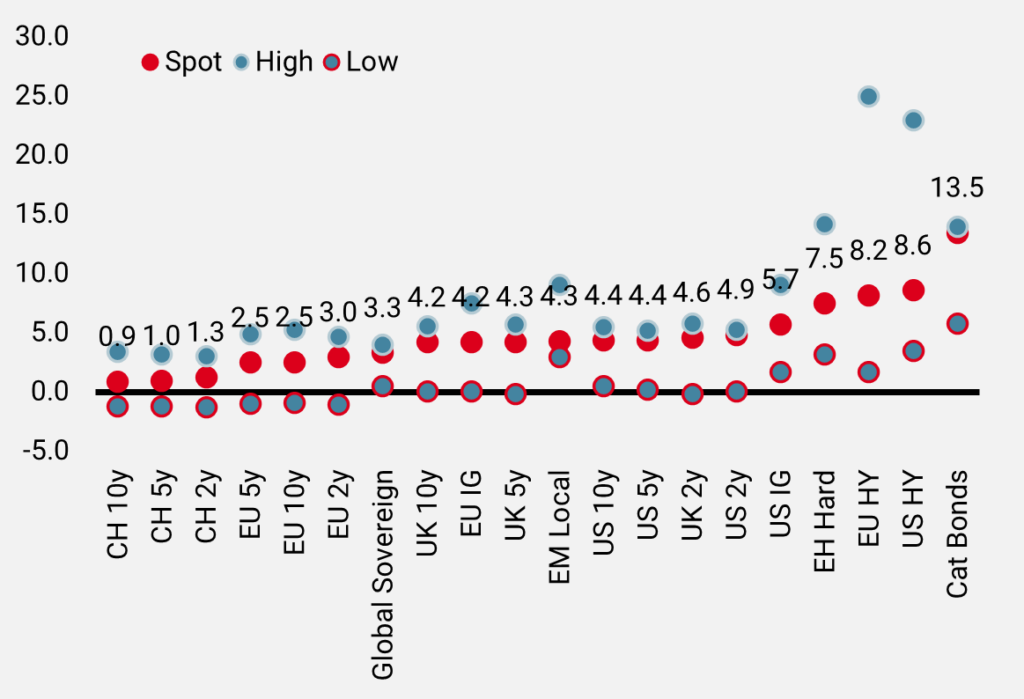

The first good news is that expected returns in the fixed income space have not been as high for at least 15 years. Cash equivalents offer 5% over a year in US Dollar terms, risk free. Adjusted for inflation, they still yield positive returns, a situation unseen for a while too.

The second good news is that with interest rates being the yield basis for any bond sub asset class, the entire fixed income universe is now offering much more attractive carry (which may even exceed the equity dividend yield) at much lower risk. Figure 3 puts things into historical perspective on a wide range of asset classes. An interesting takeaway is to observe that the US two year yield is now superior to that offered by speculative-grade bonds (high yield) in 2021.

Not a surprise then to see large scale allocation shifts happening

Figure 3: Fixed income yields – 2000-2023

Source: Bloomberg, Unigestion. As of 31.10.2023.

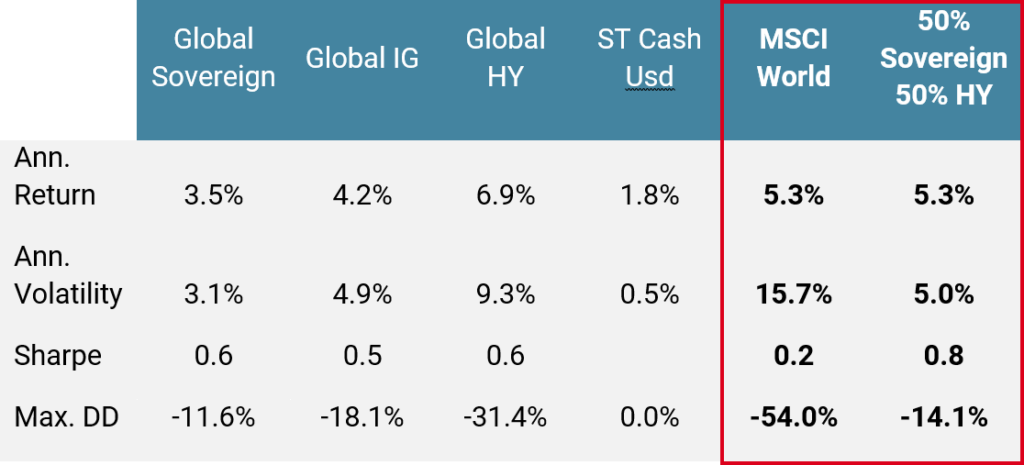

As one of the questions is whether bonds are always competitive against stocks or not, the answer lies – as often – in the observation window. Over the long run, the risk/reward ladder scale is somewhat respected: cash is the safer/lower performing asset; stocks and high yield bonds the riskier/higher performing ones. On a risk comparable basis however, using sharpe ratios, bonds have a clear advantage.

Table 1: Performance & Statistics comparison (2000-2023)

Source: Bloomberg, Unigestion. As of 31.10.2023.

Over shorter timeframes, stocks can significantly outperform bonds and vice versa, as depicted in Figure 3. So, the point is rather to identify patterns to try to predict the timely competitive advantage one will have over the other.

Figure 4: 1-year rolling returns

Source: Bloomberg, Unigestion. As of 31.10.2023.

Path dependency...when timing is key

As intuition can be misleading at times, let’s proof test some assumptions. The higher the expected return, the higher the realised return for example.

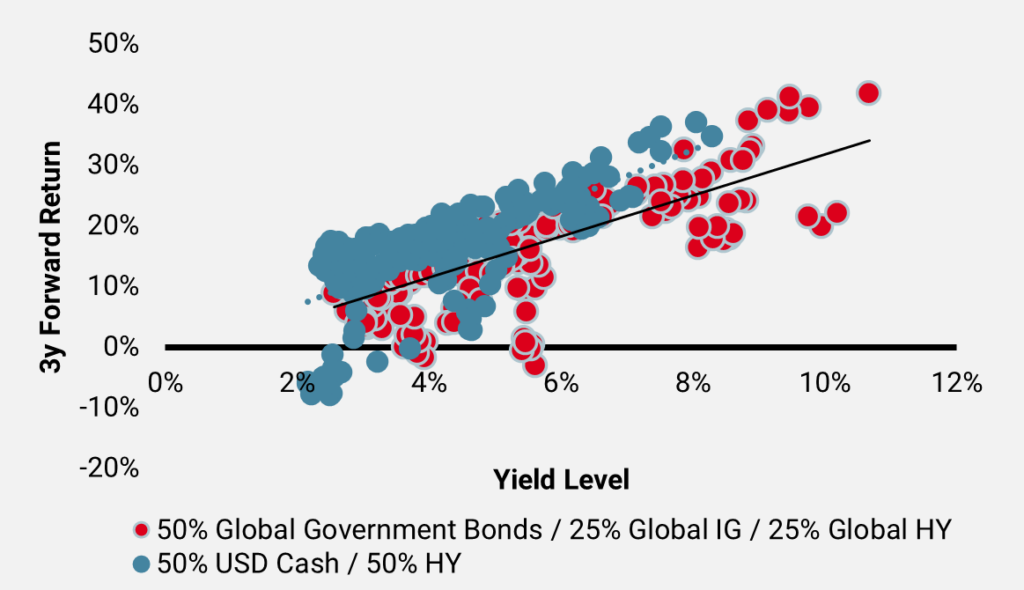

Figure 5 illustrates this relationship by comparing yields at any given point in time (x) with one year forward total returns (y). Two major observations can be drawn: firstly, it does confirm that on average, a higher yield environment does offer superior absolute returns. Secondly, and more importantly, the dispersion of realised returns diminishes past a certain threshold.

Figure 5: Conditional Forward Returns

Source: Bloomberg, Unigestion. As of 31.10.2023.

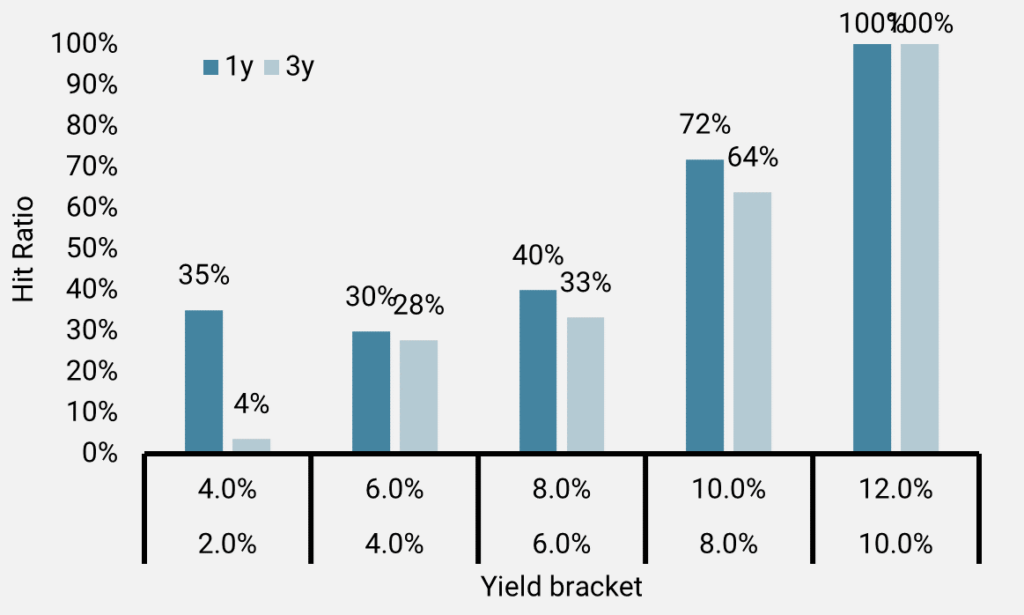

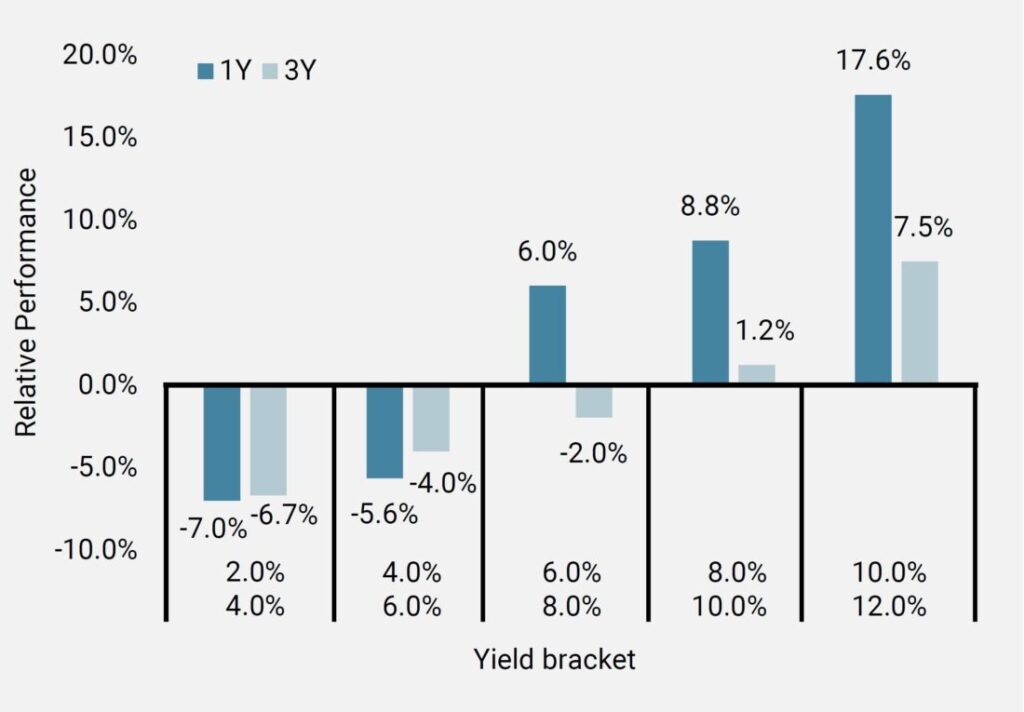

Looking at relative returns, it becomes clear that starting yields need to be quite elevated to beat their equity counterparts. Figure 6a showcases hit ratios of a 50% cash/50% high yield allocation against a portfolio only invested in equities over one and three years, contingent to the current level of yield. 6b measures the relative performance of the first over the former over the same time frames. The first observation confirms the above-mentioned intuitive relationship between absolute levels of yields and forward-looking returns, and identifies the important thresholds of competitiveness: when starting yields are superior to 7.5%, the batting average rises rapidly above 60%, while average outperformance turns positive.

Figure 6a: Conditional Hit Ratios

Source: Bloomberg, Unigestion. As of 31.10.2023.

Figure 6b: Conditional Forward Relative Performance

Source: Bloomberg, Unigestion. As of 31.10.2023.

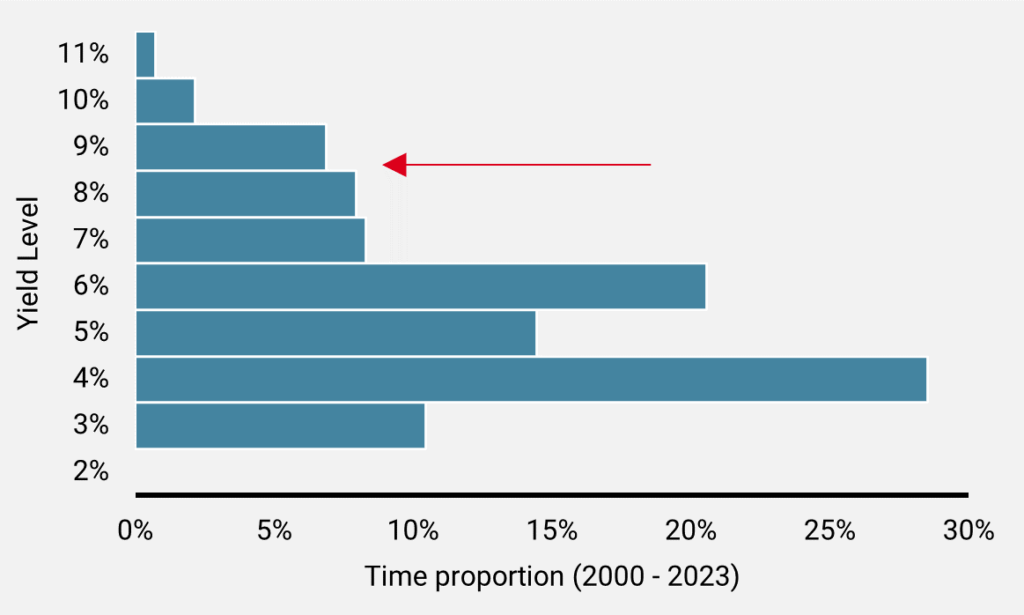

With yields currently standing at approximately 8% for an allocation comprised of cash equivalents (short term treasuries) and high yield exposures, it becomes clear that the time to reflect on strategic allocation changes has come.

Figure 7: Current conditions

Source: Bloomberg, Unigestion. As of 31.10.2023.

While it appears like an opportune time to reconsider fixed income as a very valid alternative to stocks from a “probability of success” perspective, investors also need to consider risk.

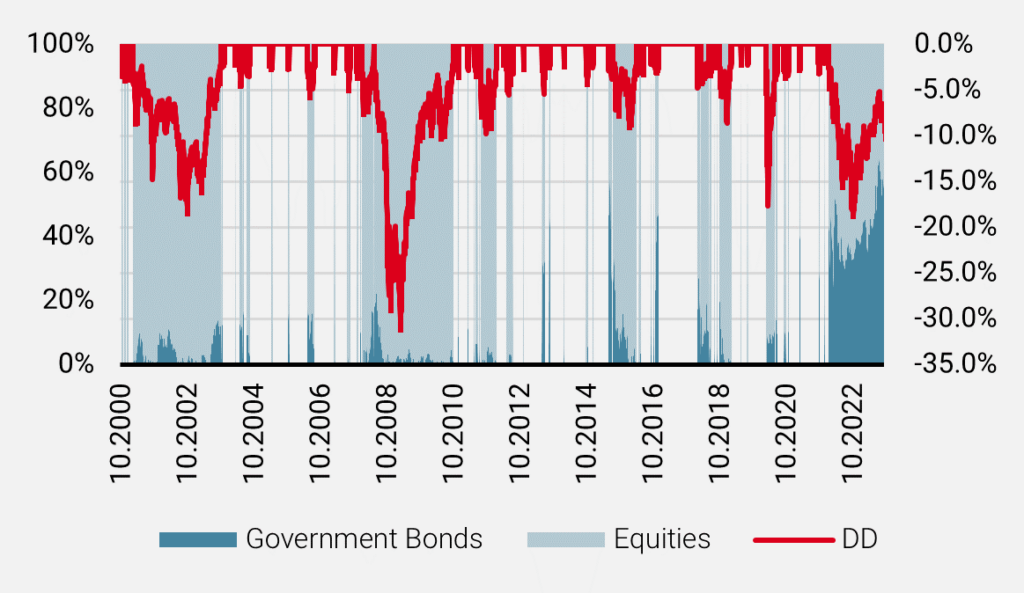

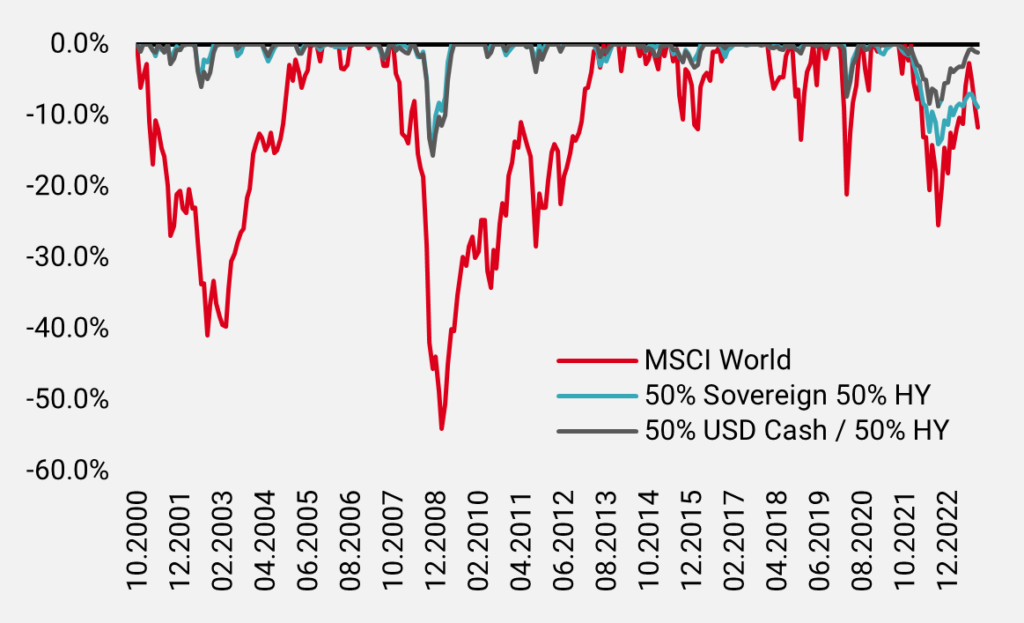

Volatility, the measure of the quantity of periodical divergence of a variable around its own mean or, put differently, how uncertain can a return stream be, offers a major advantage to bond allocations, independent of the time horizon. Over the past 20 years, fixed income volatility has been three times lower than the volatility of stocks – an appealing feature not to be overlooked. Looking at risk from a maximum loss angle, as depicted in Figure 8, once again the advantage resides with boring bonds again.

Figure 8: Rolling Drawdowns

Source: Bloomberg, Unigestion. As of 31.10.2023.

Concluding Remarks

Boring: Adj.: Not interesting or exciting.

High expected returns, lower risk and better visibility are among the major “pros” highlighting the revived attraction of fixed income. A “con” would be the ‘Fear Of Missing Out’ (FOMO) on equity returns non-withstanding one’s view on the future performance of stocks. To circumvent FOMO risk, the barbel approach that consists of keeping a large portion of assets invested into cash equivalents offers great flexibility and valid options to get exposed to stocks when needed. This can be achieved either simply by re-arbitraging into the asset class from the cash sleeve at levels deemed attractive, or by engaging into optional overlays, or any other convex/asymmetric solutions.

Important information

INFORMATION ONLY FOR YOU

This document has been prepared for your information only and must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to any other person without the prior written consent of Unigestion. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

RELIANCE ON UNIGESTION

There is no guarantee that Unigestion will be successful in achieving any investment objectives. An investment strategy contains risks, including the risk of complete loss.

Except where otherwise specifically noted, the information contained herein, including performance data and assets under management, relates to the entire affiliated group of Unigestion entities over time. Such information is intended to provide you with background regarding the services, investment strategies and personnel of the Unigestion entities. No guarantee is made that all or any of the individuals involved in generating the performance on behalf of one or more Unigestion entities will be involved in managing any specific client account on behalf of another Unigestion entity.

NOT A RECOMMENDATION OR OFFER

This is a promotional statement of our investment philosophy and services only in relation to the subject matter of this presentation. It constitutes neither investment advice nor recommendation. This document represents no offer, solicitation or suggestion of suitability to subscribe in either the investment vehicles to which it refers or to any securities or financial instruments described herein. Any such offer to sell or solicitation of an offer to purchase shall be made only by formal offering documents, which include, among others, a confidential offering memorandum, limited partnership agreement (if applicable), investment management agreement (if applicable), operating agreement (if applicable), and related subscription documents (if applicable). Such documentation contains additional information material to any decision to invest. Please contact your professional adviser/consultant before making an investment decision.

Reference to specific securities should not be construed as a recommendation to buy or sell such securities and is included for illustration purposes only.

RISKS

Where possible we aim to disclose the material risks pertinent to this document. The views expressed in this document do not purport to be a complete description of the securities, markets and developments referred to in it. Unigestion maintains the right to delete or modify information without prior notice. The risk management practices and methods described herein are for illustrative purposes only and are subject to modification.

Investors shall conduct their own analysis of the risks (including any legal, regulatory, tax or other consequences) associated with an investment and should seek independent professional advice. Some of the investment strategies or financial instruments described or alluded to herein may be construed as high risk and not readily realisable investments, and may experience substantial & sudden losses including total loss of investment. These are not suitable for all types of investors. Unigestion has the ability in its sole discretion to change the strategies described herein.

PAST PERFORMANCE

Past performance is not a reliable indicator of future results, the value of investments, can fall as well as rise, and there is no guarantee that your initial investment will be returned. Returns may increase or decrease as a result of currency fluctuations.

NO INDEPENDENT VERIFICATION OR REPRESENTATION

No separate verification has been made as to the accuracy or completeness of the information herein. Data and graphical information herein are for information only and may have been derived from third party sources. Unigestion takes reasonable steps to verify, but does not guarantee, the accuracy and completeness of information from third party sources. As a result, no representation or warranty, expressed or implied, is or will be made by Unigestion in this respect and no responsibility or liability is or will be accepted. All information provided here is subject to change without notice. It should only be considered current as of the date of publication without regard to the date on which you may access the information. An investment with Unigestion, like all investments, contains risks, including total loss for the investor.

FORWARD-LOOKING STATEMENTS

This document may contain forward-looking statements, including observations about markets and industry and regulatory trends as of the original date of this document. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect Unigestion’s views as of such date with respect to possible future events and are subject to a number of risks and uncertainties, including, but not limited to, the impact of competitive products, market acceptance risks and other risks. Actual results could differ materially from those in the forward-looking statements as a result of factors beyond a strategy’s or Unigestion’s control. You are cautioned not to place undue reliance on such statements. No party has an obligation to update any of the forward-looking statements in this document.

TARGET RETURNS

Targeted returns reflect subjective determinations by Unigestion based on a variety of factors, including, among others, internal modeling, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Target returns are based on Unigestion’s analytics including upside, base and downside scenarios and might include, but are not limited to, criteria and assumptions such as macro environment, enterprise value, turnover, EBITDA, debt, financial multiples and cash flows. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

USE OF INDICES

Information about any indices shown herein is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison. You cannot invest directly in an index and the indices represented do not take into account trading commissions and/or other brokerage or custodial costs. The volatility of the indices may be materially different from that of the strategy. In addition, the strategy’s holdings may differ substantially from the securities that comprise the indices shown.

ASSESSMENTS

Unigestion may, based on its internal analysis, make assessments of a company’s future potential as a market leader or other success. There is no guarantee that this will be realised.

No prospectus has been filed with a Canadian securities regulatory authority to qualify the distribution of units of this fund and no such authority has expressed an opinion about these securities. Accordingly, their units may not be offered or distributed in Canada except to permitted clients who benefit from an exemption from the requirement to deliver a prospectus under securities legislation and where such offer or distribution would be prohibited by law. All investors must obtain and carefully read the applicable offering memorandum which contains additional information needed to evaluate the potential investment and provides important disclosures regarding risks, fees and expenses.

Legal Entities Disseminating This Document

United Kingdom

This material is disseminated in the United Kingdom by Unigestion (UK) Ltd., which is authorized and regulated by the Financial Conduct Authority (“FCA”).

This information is intended only for professional clients and eligible counterparties, as defined in MiFID directive and has therefore not been adapted to retail clients.

United States

In the United States, Unigestion is present and offers its services in the United States as Unigestion (US) Ltd, which is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and/or as Unigestion (UK) Ltd., which is registered as an investment advisor with the SEC. All inquiries from investors present in the United States should be directed to clients@unigestion.com. This information is intended only for institutional clients that are qualified purchasers as defined by the SEC and has therefore not been adapted to retail clients.

European Union

This material is disseminated in the European Union by Unigestion Asset Management (France) SA which is authorized and regulated by the French “Autorité des Marchés Financiers” (“AMF”).

This information is intended only for professional clients and eligible counterparties, as defined in the MiFID directive and has therefore not been adapted to retail clients.

Canada

This material is disseminated in Canada by Unigestion Asset Management (Canada) Inc. which is registered as a portfolio manager and/or exempt market dealer in nine provinces across Canada and also as an investment fund manager in Ontario, Quebec and Newfoundland & Labrador. Its principal regulator is the Ontario Securities Commission (“OSC”).

This material may also be distributed by Unigestion SA which has an international advisor exemption in Quebec, Saskatchewan and Ontario. Unigestion SA’s assets are situated outside of Canada and, as such, there may be difficulty enforcing legal rights against it.

Switzerland

This material is disseminated in Switzerland by Unigestion SA which is authorized and regulated by the Swiss Financial Market Supervisory Authority (“FINMA”).

Document issued May 2024.

Related insight

- Private equity

- Perspectives

Monitoring the performance of private equity funds is a critical responsibility for Limited Partners (LPs), as it plays a key role in shaping investment decisions throughout the life of a fund

[…]- Private equity

- Perspectives

Despite geopolitical and macro-economic uncertainties, 2025 has been a largely positive year for investors with public markets posting strong gains.

While investment conditions are far from perfect, inflation globally is moderating, the IMF has slightly upgraded its growth forecasts and many central banks are shifting to a more neutral or easing stance following a significant rate hike cycle that started in 2022.

[…]- Private equity

- Press releases

Unigestion Private Equity, the global specialist in mid-market leaders, is delighted to announce the final close of Unigestion Secondary VI (USEC VI). The fund was oversubscribed at its hard cap of €1.7bn ($2bn).

[…]- Private equity

- Perspectives

The public markets shrugged off continued macroeconomic and geopolitical concerns to post respectable performance in the third quarter of 2025.

[…]