- Wealth management

- Papers

- Perspectives

Sandrine Perret

Portfolio Manager

Multi-Asset and Wealth Management

Is optimism warranted as we close the first half of 2023? The performance of equity markets in H1 could suggest so. Stocks have rallied as the macro environment has provided a relatively good mix of rapidly falling inflation with growth holding up and the largest part of rate hikes in this cycle now behind us.

The latter effect seems to be driving sentiment, although central bankers have been clear that their inflation job is making progress but is not complete. In the second half of the year, investors will witness economies that are slowing as credit conditions deteriorate and financial stress coming and going on a regular basis. Hopes for a large monetary policy pivot could be disappointed for those using the roadmap that prevailed over the last decade’s “low inflation period”. We discuss what is the right dose of risk for portfolios and how to position as we navigate these uncertainties in the next six months.

High and Dry

Radiohead, 1995

What's next

Visible progress on the inflation front

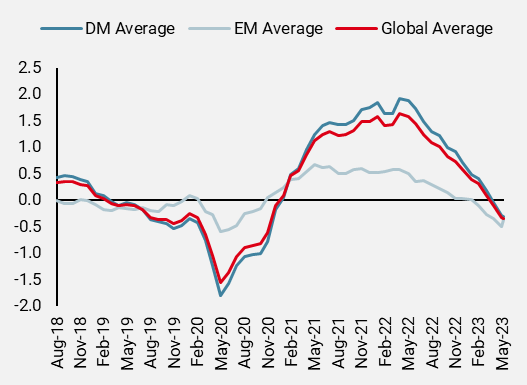

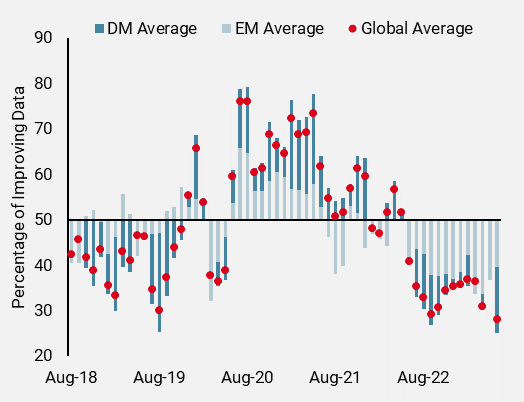

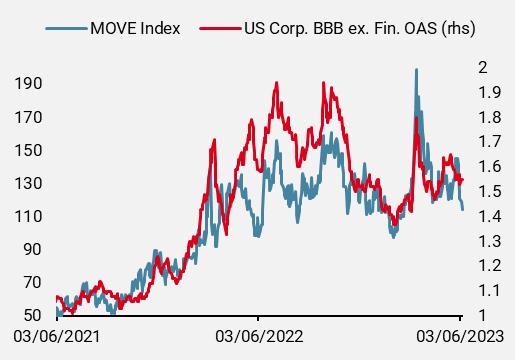

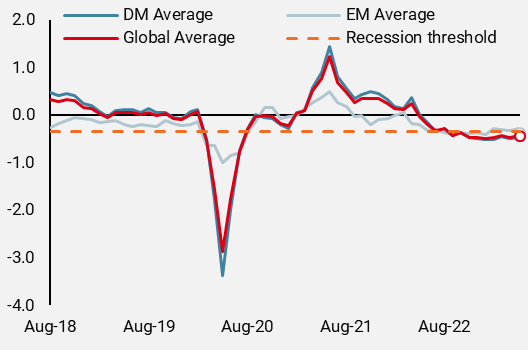

If an investor had to choose a single indicator driving financial markets over the last 12 months, short-term policy rates or inflation would be among the top answers. Indeed, back in May 2022 some developed economies saw inflation shooting up towards double digit levels while policy rates were still not far from historical lows. Fast forward a year later, the world has changed and interest rates have increased from zero to 5% in the US, and from –0.5% to above 3% in the Eurozone. This helped to push down inflation, as US headline CPI dropped to 4.9% in April from above 9% in summer 2022. The progress made on inflation is visible in our Nowcasters where both DM and EM indicators have recently declined below the zero threshold, indicating a very low inflation risk ahead (Figure 1a). The downward momentum in prices is still important, as can be measured by the diffusion index – the percentage of data increasing vs decreasing (Figure 1b).

Figure 1a: Global Inflation Nowcasters – level

Source: Bloomberg, Unigestion. As of 07.06.2023.

Figure 1b: Global Inflation Nowcasters – diffusion index

Source: Bloomberg, Unigestion. As of 07.06.2023.

Is this battle over? Probably not. Over the last 12 months, easing supply chains and falling energy prices largely contributed to price declines. Now that supply chains have normalised and goods prices are on a downward path, bringing down services costs and capping rising wages is the hard task remaining for most central banks.

As inflation normalises, economies have been resilient to the steep tightening cycle. The latest employment numbers in the US confirm that while consumers have been hit by rising prices, as of May the labour market continues to add a large quantity of jobs. Other regions are experiencing equally low unemployment rates.

Recession risks have been pushed back but persist…

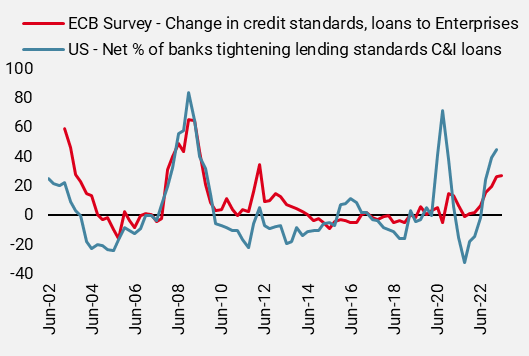

With inflation falling and growth remaining strong, one could argue that rate hikes have produced what they were meant to achieve. That is without accounting for stress in the banking sector. Credit conditions started to deteriorate at the end of 2022, and banks reported tighter credit standards and weaker demand for loans in Q1, before the emergence of banking worries (Figure 2). The collapse of Silicon Valley Bank and subsequent failure of other regional lenders and the UBS takeover of Credit Suisse in Europe will contribute to making global banks even more cautious and slow the supply of credit.

Figure 2: Credit conditions are tightening

Source: Bloomberg, Unigestion. As of 07.06.2023.

…as economies are too strong to cut

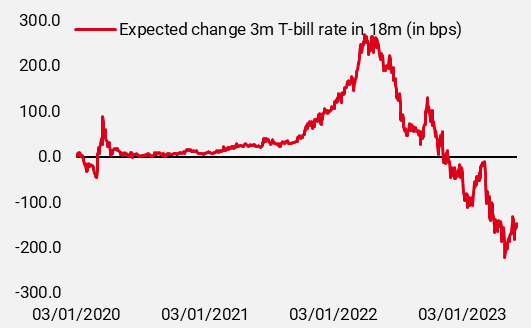

Back in April, markets were discounting not only a pause in the US rate hiking cycle, but also cuts happening as soon as this summer. That has been a main supporting factor for global stocks and risk sentiment this year, and contributed to keeping stocks’ volatility low while bond volatility remains high. While some cuts have been de-priced, we assess the prospect of rate cuts as quite optimistic, both in terms of timing and magnitude as close to 150 bps of cuts are still expected in the US over the next 18 months (Figure 3). Indeed, notwithstanding progress on reducing price pressure, G4 central banks will want to see more confirmation before declaring victory on the inflation battle and a sustained downward trend towards 2%. In addition, despite some signs of weakening activity, economic conditions remain good enough and the US job market is still strong by historical standards. In this environment, the space to cut rates for central banks remains quite narrow and they are more likely to adopt a wait and see strategy for the rest of the year. Recent speeches from FOMC members have confirmed that rate cuts are not on the cards yet.

Figure 3: Futures pricing of Fed funds rate 18 months ahead

Sources: Bloomberg, Unigestion. As of 06.06.2023.

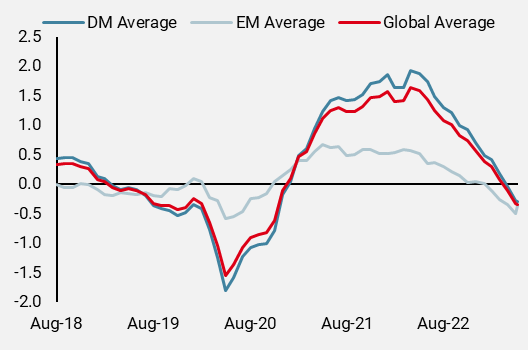

Watch for the credit as growth slows further

Even though the probability of a recession has diminished in 2023, it remains high according to our systematic growth Nowcaster indicator. With the above-mentioned banking worries persisting and market stress that could re-appear soon, we believe that risky assets will trade in a range-bound fashion in coming months and we retain a defensive tilt in portfolios. Now that the threat of a US default has been averted, macro trends and inflation dynamics will dictate the medium-term direction of market sentiment.

Figure 4: Credit spreads vs bond volatility

Sources: Bloomberg, Unigestion. As of 07.06.2023

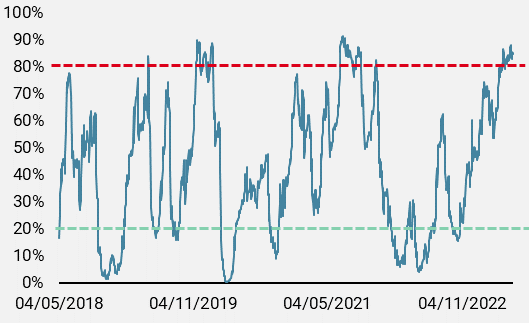

In addition, risky assets have been supported as equity markets seems to focus on the positive news of inflation normalisation and companies that reported better than expected Q1 earnings. Complacency levels are now either at, or close to, extreme optimism. (Figure 5). Investors will have to incorporate this before adding risks in portfolios later this year given the uncertainties surrounding macro developments.

Figure 5: Nasdaq complacency indicator

Source: Bloomberg, Unigestion. As of 29.05.2023

What we are monitoring

In summary, progress on reducing inflation pressures over the last few months has been a net positive for markets and risk taking – defying investors’ cautious positioning. While the rate hiking cycle is getting closer to its peak, holding US rates at 5% for longer could exacerbate the negative growth impact expected in H2 and, in turn, delay a larger risk rally in markets after the very weak performance of last year for bonds and stocks. The low volatility in markets at present is likely underestimating risks in H2, and with that in mind we would stay on the mild-cautious side, while we take advantage of the yield available in short-term high-rated credit.

What are the main factors that would make us change our view in H2? First, a steep drop of core services inflation could validate the rate cuts expectations and confirm that a monetary pivot is indeed coming sooner. This is however unlikely to happen without a sharp deterioration in activity – and would be a catalyst to buy duration. Lower earnings would suggest exposure to quality stocks rather than cyclicals.

Second, signs of systemic risk in financial markets becoming more pronounced than the short-lived banking stress of March. We would expect central banks to act in this environment, but so far these episodes of stress have been too shallow to change the monetary course. A more severe market stress could mark the start of a rate cutting cycle. Without these developments, the “high” for longer mantra driven by inflation will continue and seizing opportunities will require agility in this complex macro landscape.

Unigestion Nowcasting

World Growth Nowcaster

World Inflation Nowcaster

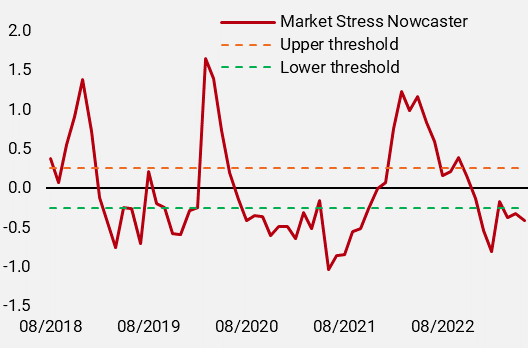

Market Stress Nowcaster

Nowcasters update

- Our Growth Nowcaster continues to point at a high risk of recession, although the slide in growth has stabilized in Q1-23.

- Our World Inflation Nowcaster as still on a strong downward trend in both EM and DM.

- Our Market Stress Nowcaster remains volatile on a week-by-week basis, driven by increases in the spread component.

Source: Bloomberg, Unigestion. As of 07.06.2023

Important information

INFORMATION ONLY FOR YOU

This document has been prepared for your information only and must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to any other person without the prior written consent of Unigestion. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

RELIANCE ON UNIGESTION

There is no guarantee that Unigestion will be successful in achieving any investment objectives. An investment strategy contains risks, including the risk of complete loss.

Except where otherwise specifically noted, the information contained herein, including performance data and assets under management, relates to the entire affiliated group of Unigestion entities over time. Such information is intended to provide you with background regarding the services, investment strategies and personnel of the Unigestion entities. No guarantee is made that all or any of the individuals involved in generating the performance on behalf of one or more Unigestion entities will be involved in managing any specific client account on behalf of another Unigestion entity.

NOT A RECOMMENDATION OR OFFER

This is a promotional statement of our investment philosophy and services only in relation to the subject matter of this presentation. It constitutes neither investment advice nor recommendation. This document represents no offer, solicitation or suggestion of suitability to subscribe in either the investment vehicles to which it refers or to any securities or financial instruments described herein. Any such offer to sell or solicitation of an offer to purchase shall be made only by formal offering documents, which include, among others, a confidential offering memorandum, limited partnership agreement (if applicable), investment management agreement (if applicable), operating agreement (if applicable), and related subscription documents (if applicable). Such documentation contains additional information material to any decision to invest. Please contact your professional adviser/consultant before making an investment decision.

Reference to specific securities should not be construed as a recommendation to buy or sell such securities and is included for illustration purposes only.

RISKS

Where possible we aim to disclose the material risks pertinent to this document. The views expressed in this document do not purport to be a complete description of the securities, markets and developments referred to in it. Unigestion maintains the right to delete or modify information without prior notice. The risk management practices and methods described herein are for illustrative purposes only and are subject to modification.

Investors shall conduct their own analysis of the risks (including any legal, regulatory, tax or other consequences) associated with an investment and should seek independent professional advice. Some of the investment strategies or financial instruments described or alluded to herein may be construed as high risk and not readily realisable investments, and may experience substantial & sudden losses including total loss of investment. These are not suitable for all types of investors. Unigestion has the ability in its sole discretion to change the strategies described herein.

PAST PERFORMANCE

Past performance is not a reliable indicator of future results, the value of investments, can fall as well as rise, and there is no guarantee that your initial investment will be returned. Returns may increase or decrease as a result of currency fluctuations.

NO INDEPENDENT VERIFICATION OR REPRESENTATION

No separate verification has been made as to the accuracy or completeness of the information herein. Data and graphical information herein are for information only and may have been derived from third party sources. Unigestion takes reasonable steps to verify, but does not guarantee, the accuracy and completeness of information from third party sources. As a result, no representation or warranty, expressed or implied, is or will be made by Unigestion in this respect and no responsibility or liability is or will be accepted. All information provided here is subject to change without notice. It should only be considered current as of the date of publication without regard to the date on which you may access the information. An investment with Unigestion, like all investments, contains risks, including total loss for the investor.

FORWARD-LOOKING STATEMENTS

This document may contain forward-looking statements, including observations about markets and industry and regulatory trends as of the original date of this document. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect Unigestion’s views as of such date with respect to possible future events and are subject to a number of risks and uncertainties, including, but not limited to, the impact of competitive products, market acceptance risks and other risks. Actual results could differ materially from those in the forward-looking statements as a result of factors beyond a strategy’s or Unigestion’s control. You are cautioned not to place undue reliance on such statements. No party has an obligation to update any of the forward-looking statements in this document.

TARGET RETURNS

Targeted returns reflect subjective determinations by Unigestion based on a variety of factors, including, among others, internal modeling, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Target returns are based on Unigestion’s analytics including upside, base and downside scenarios and might include, but are not limited to, criteria and assumptions such as macro environment, enterprise value, turnover, EBITDA, debt, financial multiples and cash flows. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

USE OF INDICES

Information about any indices shown herein is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison. You cannot invest directly in an index and the indices represented do not take into account trading commissions and/or other brokerage or custodial costs. The volatility of the indices may be materially different from that of the strategy. In addition, the strategy’s holdings may differ substantially from the securities that comprise the indices shown.

ASSESSMENTS

Unigestion may, based on its internal analysis, make assessments of a company’s future potential as a market leader or other success. There is no guarantee that this will be realised.

No prospectus has been filed with a Canadian securities regulatory authority to qualify the distribution of units of this fund and no such authority has expressed an opinion about these securities. Accordingly, their units may not be offered or distributed in Canada except to permitted clients who benefit from an exemption from the requirement to deliver a prospectus under securities legislation and where such offer or distribution would be prohibited by law. All investors must obtain and carefully read the applicable offering memorandum which contains additional information needed to evaluate the potential investment and provides important disclosures regarding risks, fees and expenses.

Legal Entities Disseminating This Document

United Kingdom

This material is disseminated in the United Kingdom by Unigestion (UK) Ltd., which is authorized and regulated by the Financial Conduct Authority (“FCA”).

This information is intended only for professional clients and eligible counterparties, as defined in MiFID directive and has therefore not been adapted to retail clients.

United States

In the United States, Unigestion is present and offers its services in the United States as Unigestion (US) Ltd, which is registered as an investment advisor with the U.S. Securities and Exchange Commission (“SEC”) and/or as Unigestion (UK) Ltd., which is registered as an investment advisor with the SEC. All inquiries from investors present in the United States should be directed to clients@unigestion.com. This information is intended only for institutional clients that are qualified purchasers as defined by the SEC and has therefore not been adapted to retail clients.

European Union

This material is disseminated in the European Union by Unigestion Asset Management (France) SA which is authorized and regulated by the French “Autorité des Marchés Financiers” (“AMF”).

This information is intended only for professional clients and eligible counterparties, as defined in the MiFID directive and has therefore not been adapted to retail clients.

Canada

This material is disseminated in Canada by Unigestion Asset Management (Canada) Inc. which is registered as a portfolio manager and/or exempt market dealer in nine provinces across Canada and also as an investment fund manager in Ontario, Quebec and Newfoundland & Labrador. Its principal regulator is the Ontario Securities Commission (“OSC”).

This material may also be distributed by Unigestion SA which has an international advisor exemption in Quebec, Saskatchewan and Ontario. Unigestion SA’s assets are situated outside of Canada and, as such, there may be difficulty enforcing legal rights against it.

Switzerland

This material is disseminated in Switzerland by Unigestion SA which is authorized and regulated by the Swiss Financial Market Supervisory Authority (“FINMA”).

Document issued May 2024.

Related insight

- Private equity

- Press releases

Unigestion Private Equity, the global specialist in mid-market leaders, is delighted to announce the final close of Unigestion Secondary VI (USEC VI). The fund was oversubscribed at its hard cap of €1.7bn ($2bn).

[…]- Private equity

- Perspectives

The public markets shrugged off continued macroeconomic and geopolitical concerns to post respectable performance in the third quarter of 2025.

[…]- Private equity

- Corporate

Welcome to the Unigestion Fireside Chat, where we sit down with our experts and explore the latest trends across the private equity industry.

[…]- Private equity

- Press releases

Unigestion Private Equity, the asset manager focused on investing in private equity’s mid-market leaders, has agreed to sell its stake in Tecvia to Harris Computer.

[…]